To err is human. To forgive divine. More than 11 million people have a criminal record in the UK. In fact, a third of men and nearly 10% of women are expected to be convicted of an offence by the age of 53 according to the Metro.

Home insurance with criminal conviction on your record can be very difficult.

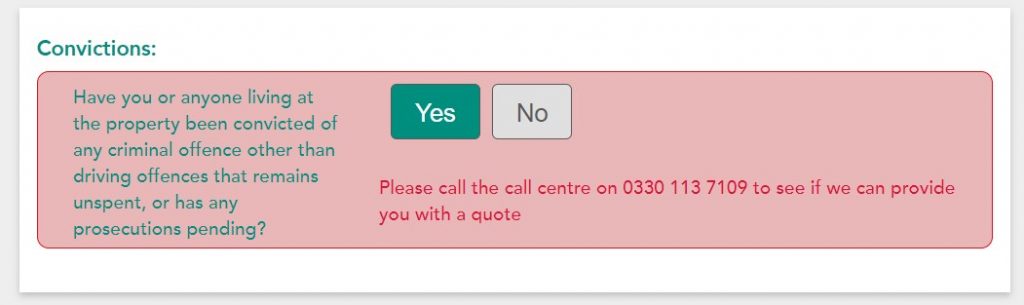

At Emerald Life please email or call us to discuss details of your unspent conviction to see if we can provide you with a home insurance quote. In many cases we can and it’s just a question of pricing any (general) extra risk.

If your conviction has been spent then you can simply get a quote online.

We also do not include driving offences as criminal convictions.

In particular, insurers tend to be wary about unspent criminal convictions. If you have offence is now treated as spent then you do not need to declare it when applying for insurance. That is because you have paid your dues and can move on.

On the other hand, you must declare to your insurer any unspent criminal convictions if asked. If you don’t then your cover could be invalid and so the insurer is likely to refuse to pay out in the event of a claim.

However, declaring unspent convictions can tightly narrow your pool of insurers willing to cover you.

In these cases you will often have to contact insurers directly and explain your situation.

Some of the information they may ask for could include:

- The type of conviction – most insurers will probably be more open to insuring customers convicted of driving offences than, say, assault.

- When the conviction occured.

- Who the conviction relates to – a policy holder or a family member?

- What was the fine or sentence that was handed down?

- How the conviction affects your current circumstances. For instance, employment.

After gathering the information they require an insurer will say whether or not they can provide cover. It is likely that you may have a loading applied – meaning that your premium is increased by a percentage to account for the conviction. Similarly you may be offered cover but with certain items excluded.

Insurers’ attitude to risk is often quite fluid. If one insurer finds they have a lot of criminal convictions on their books – or a lot of convictions for the same sort of crime – they may start turning down applications for a period. On the other hand, other insurers may be more open to special situations like convictions.

Therefore it is always worth shopping around to compare cover as an insurer that declined you or gave you a high premium one year might be more open the next. Getting home insurance with criminal conviction is possible but check every year as a spent conviction can be removed from the discussion.

How Can I Protect Myself?

You may feel vulnerable applying for home insurance with criminal conviction in your history. Not only might you be refused or pay more but you may be worried about an insurer refusing to pay out on a claim.

Here are some ways you can help protect yourself and make sure you are covered.

- Always disclose your convictions if asked – including people in your household. In general it is probably better to be clear and honest throughout rather than risk hiding anything important.

- Get written proof of your disclosure. This should really be printed on your Statement of Fact which lists all your declarations when getting home insurance. If it isn’t then request written confirmation.

- If you have a claim refused and feel you have been mistreated then you can go to the Financial Ombudsman Service.

What About Driving Offences?

In general you should always be transparent with your insurer. A lot of insurers do not include driving offences as criminal convictions. However, it is best to check with them if this is not obvious from their online quote form or phone conversation. Remember that home insurance with criminal conviction is possible with more flexible insurers, but do contact them to make sure.

Article: Home insurance with criminal conviction